Form 8283 2025 – Fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the understatement of tax liability). Must be removed before printing. For items requiring an appraisal, remember to attach the appraisal document. This form is for income earned in tax year 2024, with tax returns due in april 2025.we will update this page with a new version of the form for 2026 as soon as it is made available by the federal government.

Attach form 8283 to your tax return if you are claiming deductions for noncash contributions. Returning member mark as new; Most of my clientbase earn over 100k; Filing requirements and important notes.

Form 8283 2025

Form 8283 2025

The change is in the rule about charitable donations can't exceed 30% of your agi. The form is available and in use in other tax software programs. However, i don't like having it being less on the federal form versus the state.

I’m comfortable with how i’ve worked around it. There’s no changes to the form. Common mistakes to avoid on form 8283.

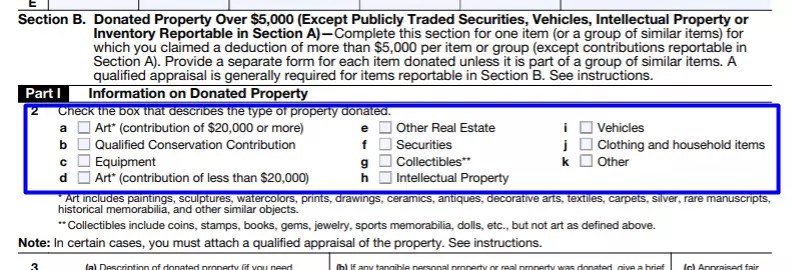

If you are donating property worth $5,000 or more, you. Now the date for form 8283 has been changed to 2/13/2025. I also understand that, if there is a

Form 8283 is used to claim a deduction for a charitable. We last updated federal form 8283 in january 2025 from the federal internal revenue service. The forms availability table was updated today and shows the form 8283 is now scheduled to become available in turbotax sometime tomorrow on 2/05/2025 unless there is further delay.

IRS Form 8283 ≡ Fill Out Printable PDF Forms Online

Learn How to Fill the Form 8283 Noncash Charitable Contributions YouTube

IRS Form 8283 ≡ Fill Out Printable PDF Forms Online

for How to Fill in IRS Form 8283

2024 Guide To IRS 8283 Noncash Charitable Donation Appraisers PrestigeEstate Services Inc.

IRS Form 8282 Instructions Donee Information Return

Form 8283 and Non cash Charitable Contribution Eqvista

Form 8283 Example Return (2025) IRS Form 8283 What It Is, How to Fill It Out 💰 TAXES S5•E166 YouTube

IRS Form 8283 ≡ Fill Out Printable PDF Forms Online

IRS Form 8283 Instructions Noncash Charitable Contributions

IRS Form 8283 Instructions Noncash Charitable Contributions

Qualified Noncash Charitable Appraisals Reporting Compliance And Toeing The Line

20232025 Form IRS Instruction 8283 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8283 guide 2025

How to Complete IRS Form 8283